Filed by the Registrant | | | ☒ | ||

Filed by a Party other than the Registrant | | | ☐ | ||

Check the appropriate box: | | | |||

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

STRIDE, INC. | ||||

(Name of Registrant as Specified | ||||

(Name of Person(s) Filing Proxy Statement, if | ||||

☒ | | | No fee required. | |||

| | | | |||

☐ | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| | (1) | | | Title of each class of securities to which transaction applies: | ||

| | | | ||||

| | | (2) | | | Aggregate number of securities to which transaction applies: | |

| | | | ||||

| | | (3) | | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | | | ||||

| | | (4) | | | Proposed maximum aggregate value of transaction: | |

| | | | ||||

| | | (5) | | | Total fee paid: | |

| | | | |||

☐ | | | Fee paid previously with preliminary materials. | |||

| | | | |||

☐ | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | | | Amount Previously Paid: | ||

| | | | ||||

| | | (2) | | | Form, Schedule or Registration Statement No.: | |

| | | | ||||

| | (3) | | | Filing Party: | ||

| | | | | |||

| | | (4) | | | Date Filed: | |

| | | | | |||

27, 2021

| | | | Sincerely, | |

| | |  | ||

| ||||

| | | Nathaniel A. Davis | ||

| | | Executive Chairman |

| | Important Information Regarding Meeting Attendance | |

| | | |

| | We are sensitive to the public health and travel concerns our stockholders may have regarding our in person Annual Meeting and recommendations that public health officials have issued and may issue in light of the | |

STOCKHOLDERS

1.Elect eight (8) directors to the Company's Board of Directors each to serve for a one-year term;2.Consider and vote upon a non-binding advisory resolution approving the compensation of the named executive officers of the Company ("Say on Pay");3.Consider and vote upon the ratification of the appointment of BDO USA, LLP, as the Company's independent registered public accounting firm for the fiscal year ending June 30, 2019; and4.Act upon such other matters as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting.

| 1. | Elect nine (9) directors to the Company’s Board of Directors each to serve for a one-year term; |

| 2. | Consider and vote upon the ratification of the appointment of BDO USA, LLP, as the Company’s independent registered public accounting firm for the fiscal year ending June 30, 2022; |

| 3. | Consider and vote upon a non-binding advisory resolution approving the compensation of the named executive officers of the Company (“Say-on-Pay”); |

| 4. | Consider and vote upon a stockholder proposal regarding a report on lobbying; and |

| 5. | Act upon such other matters as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

This year we11, 2021.

27, 2021.

27, 2021 Summary Compensation Table for Fiscal other matters as may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. through a broker, bank or other nominee must bring a legal proxy, which can be obtained only from the broker, bank or other nominee. be supplemented by telephone or personal solicitation by our directors, officers or other regular employees of the Company. No additional compensation will be paid to our directors, officers or other regular employees for these services. Stride@dfking.com. Meetings; Attendance at information that he can use to assist the Executive Chairman and CEO to function in the most effective manner. The Board of Directors believes the Lead Independent Director provides additional independent oversight of executive management and Board matters. Oversight Audit Committee Compensation Committee Nominating and Corporate Governance Committee Academic Committee then votepromptly submit your proxy or voting instructions by Internet, by phonetelephone, or sign, date and return your proxy card (if you request a paper copy) at your earliest convenience. Sending in your proxy cardmail. Voting before the Annual Meeting will not prevent you from voting your shares at the Annual Meeting, if you desire to do so. By Order of the Board of Directors, ![]()

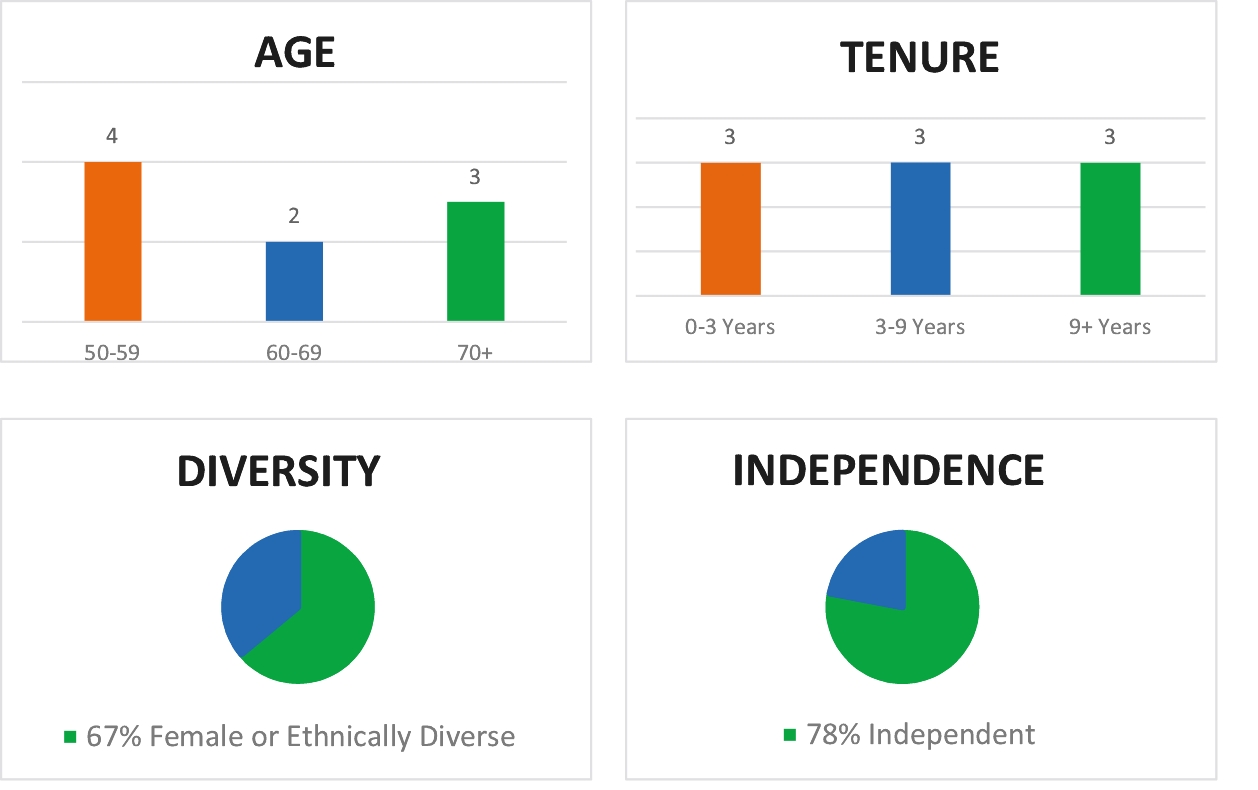

26, 2018IMPORTANT NOTICE ABOUT THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 14, 20182018 Proxy StatementCompany’s 2021 proxy statement and the 20182021 Annual Report are available at: www.edocumentview.com/LRN.at PROXY STATEMENT QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALS CORPORATE GOVERNANCE AND BOARD MATTERS Board of Directors Director Independence Board of Directors Leadership Structure Committees of the Board of Directors Director Compensation for Fiscal 2018 NOMINEES FOR ELECTION AT THE ANNUAL MEETING Executive Officers COMPENSATION DISCUSSION AND ANALYSIS Executive Summary 212018 Performance Highlights24Executive Compensation Principles and Practices25Tying Executive Pay to Company Performance27Determining Executive Compensation28Fiscal 2018 Compensation Decisions29New Fiscal 2019 Long-Term Shareholder Performance Plan39Other Compensation40Compensation Governance, Process and Incentive Decisions41Other Compensation Policies and Practices42COMPENSATION TABLES452018 COMPENSATION COMMITTEE REPORT CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS Compensation Committee Interlocks and Insider Participation PROPOSAL 2: ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION 57Prior Year Vote and Fiscal 2018 Compensation HighlightsPROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR59Fees Paid to Independent Registered Public Accounting Firm59AUDIT COMMITTEE REPORT60SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT61SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE63INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED ON63DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS63PROPOSALS BY OUR STOCKHOLDERS63WHERE YOU CAN FIND MORE INFORMATION64 TO BE HELD ONDECEMBER 14, 201826, 201827, 2021 we mailed a Notice of Internet Availability of Proxy Materials ("Notice"(“Notice”) to all stockholders entitled to vote at the Annual Meeting. The Notice tells you how to:•ViewK12Stride, Inc. Annual Report to Stockholders for the fiscal year ended June 30, 2018,2021 on the Internet and vote; and•InstructK12Stride, Inc., a Delaware corporation, for use at the annual meeting of stockholders to be held at the law firm of Latham & Watkins LLP, 555 Eleventh Street, N.W.,NW, Suite 1000, Washington, D.C.DC 20004-1304, on Friday, December 14, 2018,10, 2021, at 10:00 A.M.a.m., Eastern Time, and any adjournments or postponements thereof ("(“Annual Meeting"Meeting”). "K12," "we," "our," "us"“Stride,” “we,” “our,” “us” and the "Company"“Company” each refer to K12Stride, Inc. The mailing address of our principal executive offices is 2300 Corporate Park Drive, Herndon, VA 20171. This Proxy Statement will be made available on or about October 26, 2018,27, 2021, to holders of record as of the close of business on October 19, 201818, 2021 of our common stock, par value $0.0001 per share ("(“Common Stock"Stock”).19, 201818, 2021 as the record date ("(“Record Date"Date”) for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, we had 40,193,56442,766,739 shares of Common Stock outstanding and entitled to vote.The presence, in person or by duly executed proxy, of stockholders representing aall the votesshares of Common Stock issued and outstanding and entitled to be castvote at the Annual Meeting, the holders of which are present in person or represented by proxy, will constitute a quorum.quorum for the transaction of business at the Annual Meeting. If a quorum is not present at the Annual Meeting, we expect that the Annual Meeting will be adjourned or postponed to solicit additional proxies.present: (i)present, a plurality of votes present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect the members of the Board of Directors; and an affirmative vote of a majority of the votes present in person or represented by proxy at the Annual Meeting is required for (ii) the non-binding advisory resolution approving the executive compensation of the named executive officers of the Company, (iii)(i) the ratification of the appointment of BDO USA, LLP as the Company'sCompany’s independent registered public accounting firm for the fiscal year ending June 30, 2019 ("2022 (“fiscal 2019"2022”), (ii) the non-binding advisory resolution approving the compensation of the named executive officers (“NEOs”) of the Company, (iii) the approval of the stockholder proposal regarding a report on lobbying, and (iv) such••named executive officersNEOs of the Company;•FOR3,4, the ratification of the appointment of BDO USA, LLP as the Company's independent registered public accounting firm for fiscal 2019;stockholder proposal regarding a report on lobbying; and•proxy;proxy card; (iii) voting again by telephone or (iii) attending(iv) voting again via the Internet, including during the Annual Meeting and voting in person.Meeting. Attendance at the Annual Meeting will not, in and of itself, constitute revocation of a proxy. Any written notice revoking a proxy should be delivered to K12Stride, Inc., Attn: General Counsel and Secretary, 2300 Corporate Park Drive, Herndon, VA 20171. If your shares of Common Stock are heldregistered in a brokerage account,the name of your broker, bank or other nominee, you must follow your broker'sthe instructions of such broker, bank or other nominee to revoke a proxy.Abstentions and Broker Non-VotesBroker non-votes occur when a nominee holdingvoting securities forCommon Stock in their own names should provide identification and have their ownership verified against the list of registered stockholders as of the close of business on the Record Date. Those who have beneficial ownership of stock through a beneficial owner does not vote on a particular proposal because thebroker, bank or other nominee does not have discretionary voting power on that item and has not received instructionsmust bring account statements or letters from the beneficial owner. Abstentions, withheld votes, and broker, non-votes are included in determining whether a quorum is present but are not deemed a vote cast "For"bank or "Against" a given proposal, and therefore, are not included in the tabulationother nominee indicating that they owned Common Stock as of the voting results. As such, abstentions, withheld votes and broker non-votes do not affectclose of business on the voting results with respectRecord Date.election of directors. Abstentionspublic health and broker non-votes willtravel concerns our stockholders may have the effect of a vote against the approval of any items requiring the affirmative voteregarding our in person Annual Meeting and recommendations that public health officials have issued and may issue in light of the holderscontinuing public health crisis caused by COVID-19. As a result, we will enforce appropriate protocols consistent with then applicable federal, state and local guidelines, mandates or recommendations or facility requirements. These requirements may include the use of a majorityface coverings, proof of vaccination and maintaining appropriate social distancing. We may also impose additional procedures or greaterlimitations on meeting attendees. We plan to announce any such updates on our website https://investors.stridelearning.com/governance/2021-annual-meeting/default.aspx, and we encourage you to check this website prior to the meeting if you plan to attend.outstandingAnnual Meeting will be provided during the Annual Meeting. To vote at the Annual Meeting, those who have beneficial ownership of Common Stock entitled to vote.("(“DF King"King”) to assist in obtaining proxies from stockholders for the Annual Meeting. The estimated cost of such services is $17,500, plus out-of-pocket expenses. DF King may be contacted at (800) 431-9633(866) 829-1035 (banks and brokers may call (212) 269-5550) or via email at K12@dfking.com.thirty (30)30 days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting. We do not currently intend to seek an adjournment of the Annual Meeting.ContentsQUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND THESE PROXY MATERIALSThe following addresses some questions you may have regarding the matters to be voted uponDirectors currently consists of eleven members, each of whose term expires at the Annual Meeting. These questions and answers may not address all questions that may be importantNine of the eleven directors have been nominated for reelection for a term expiring at the 2022 annual meeting of stockholders. Each of the nominees has agreed to youserve as a stockholderdirector if elected, and the Company believes that each nominee will be available to serve.Company. Please referdirector nominees. The Board of Directors believes that this balance in age and tenure, mix of diversity, and wide range of backgrounds and experience will help bring broad and valuable perspectives to the more detailed information contained elsewhere in this Proxy Statement and the documents referred to or incorporated by reference in this Proxy Statement for additional information.Why am I receiving this Proxy Statement?The Company is soliciting proxies for the Annual Meeting. You are receiving a Proxy Statement because you owned shares of Common Stock at the close of business on October 19, 2018, the Record Date for the Annual Meeting, which entitles you to vote at the Annual Meeting. By use of a proxy, you can vote whether or not you attend the Annual Meeting. This Proxy Statement describes the matters on which we would like you to vote and provides information on those matters so that you can make an informed decision.Why is K12 calling the Annual Meeting?We are calling the Annual Meeting and submitting proposals to stockholders of the Company to consider and vote upon Annual Meeting matters, including the election of directors, a non-binding advisory resolution approving the compensation of the Company's named executive officers, and the ratification of the appointment of our independent registered public accounting firm.How does the Board of Directors recommend that I vote?will lead to a well-functioning Board.

Our BoardTABLE OF CONTENTSDirectors recommends that you voteFORthe electionnominees, their principal occupations and employment during the past five years, and other information regarding them are as follows.

the Board of Director nominees named in Proposal 1 andFOR each of Proposals 2 and 3.What do I need to do now?After carefully reading and considering the information in this Proxy Statement, please vote electronically via the Internet or by telephone by following the instructions provided by your bank or broker or complete, date, sign and promptly mail the proxy card (if you request a paper copy) in the envelope provided, which requires no postage if mailed in the United States.May I vote in person?Yes. If you were a stockholder of record as of the close of business on October 19, 2018, you may attend the Annual Meeting and vote your shares in person instead of voting by Internet or telephone or returning your signed proxy card (if you request a paper copy). However, we urge you to vote in advance even if you are planning to attend the Annual Meeting.How do I vote if my shares are held in "street name" by my bank, broker or agent?If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail your voting instructions as directed by your broker or bank to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy fromyour broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.If my shares are held in "street name" by a broker, will my broker vote my shares for me even if I do not give my broker voting instructions?Under the rules that govern brokersour current executive officers who have record ownership of shares that are held in "street name" for their clients, brokers may vote such shares on behalf of their clients with respect to "routine" matters (such as the ratification of auditors in Proposal 3), but not with respect to non-routine matters (such as Proposals 1 and 2). If the proposals to be acted upon at the Annual Meeting include both routine and non-routine matters, the broker may turn in a proxy card for uninstructed shares that votes on the routine matters, but expressly states that the broker is not voting on non-routine matters. This is calledalso a "broker non-vote" as to non-routine matters. Broker non-votes on non-routine matters will be counted for the purpose of determining the presence or absence of a quorum, but will not be counted for the purpose of determining the number of votes cast. We encourage you to provide specific instructions to your broker by returning your proxy card or by voting electronically via the Internet or by telephone, if permitted by the broker or other nominee that holds your shares. This ensures that your shares will be properly voted at the Annual Meeting.

Can I revoke my proxy and change my vote?Yes. You have the right to revoke your proxy at any time prior to the time your shares are voted at the Annual Meeting. If you are a stockholder of record, your proxy can be revoked in several ways: by timely delivery of a written revocation to our corporate secretary, by submitting another valid proxy bearing a later date or by attending the Annual Meeting and voting your shares in person, even if you have previously voted using one of the available methods.When and where is the Annual Meeting?The Annual Meeting will be held on December 14, 2018 at 10:00 A.M., Eastern Time, at the law firm of Latham & Watkins LLP, 555 Eleventh Street, N.W., Suite 1000, Washington, DC 20004-1304.Who can help answer my questions regarding the Annual Meeting or the proposals?You may contact K12 to assist you with questions about the Annual Meeting. You may reach K12 at:K12 Inc.Attention: Investor Relations2300 Corporate Park DriveHerndon, VA 20171(703) 483-7000You may also contact DF King to assist you with questions about proxies or voting. You may reach DF King at:D.F. King & Co.,Inc.,48 Wall Street, 22nd FloorNew York, New York 10005(800) 431-9633Banks and brokers may call (212) 269-5550TABLE OF CONTENTS

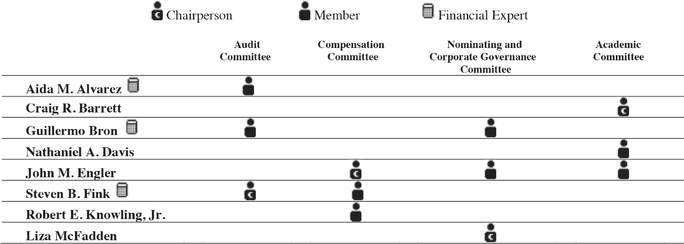

CORPORATE GOVERNANCE AND BOARD MATTERS Corporate Governance Guidelines and Code of Business Conduct and EthicsOur Board of Directors oversees the management of the Company and its business for the benefit of our stockholders in order to enhance stockholder value over the long-term and to achieve its educational mission. The Board of Directors has adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities. The Guidelines are reviewed annually and periodically amended as the Board of Directors enhances the Company's corporate governance practices. The Board of Directors has also adopted a Code of Business Conduct and Ethics that applies to all directors, officers and employees. The purpose of this code is to promote honest and ethical conduct for conducting the business of the Company, consistent with the highest standards of business ethics. The Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on our website at www.K12.com under theK12 Corporate-Investor Relations-Governance section.Our corporate governance and business conduct best practices include:•Regular executive sessions of non-management directors;•Independent directors except our Chairman of the Board and Chief Executive Officer ("CEO");•An over-boarding policy limiting other board service;•A Lead Independent Director with delineated authority and responsibility;•Director and executive officer stock ownership guidelines; and•A policy prohibiting hedging, pledging and short sales of our stock.We intend to satisfy the disclosure requirements under the Securities Exchange Act of 1934, as amended ("Exchange Act"), regarding any amendment to, or waiver from a material provision of our Code of Business Conduct and Ethics involving our principal executive, financial or accounting officer or controller by posting such information on our website.Term of Office. All directors of the Company serve terms of one year and until the election and qualification of their respective successors.Board and CommitteeAnnual Meetings and the 2017 Annual Meeting.ten11 times in person or telephonically during fiscal 2018.2021. Each director attended at least 75% of the total Board and committee meetings to which they were assigned. Our policy with respect to director attendance at the annual meeting of stockholders is to encourage, but not require, director attendance. Two membersMr. Davis was the only then-serving member of our Board of Directors attendedto attend our 2017 Annual Meeting2020 annual meeting of Stockholders: Messrs. Davis and Udell.stockholders. Our director attendance policy is included in our Corporate Governance Guidelines, which isare available on our website at www.K12.com.https://investors.stridelearning.com/governance.ContentsDirectors are duly elected at the Annual Meeting, then each of our directors, other than Messrs. Davis and Rhyu, will serve as an independent director. CommunicationTABLE OF CONTENTS ��� Directors.the candidate’s other professional and personal pursuits;K12Stride, Inc., 2300 Corporate Park Drive, Herndon, VA 20171, Attention: General Counsel and Secretary. Our General Counsel will monitor these communications and provide summaries of all received communications to our Board of Directors at its regularly scheduled meetings. Where the nature of a communication warrants, our General Counsel may decide to seek the more immediate attention of the appropriate committee of the Board of Directors or an individual director, or our management or independent advisors and will determine whether any response is necessary. Director IndependenceOur Board of Directors has affirmatively determined that each of our non-employee directors is "independent" as defined in the currently applicable listing standards of the New York Stock Exchange ("NYSE") and the rules and regulations of the Securities and Exchange Commission ("SEC"). Mr. Davis is not independent under either NYSE or SEC rules because he is an executive officer of the Company. If the nominees for the Board of Directors are duly elected at the Annual Meeting, then each of our directors, other than Mr. Davis, will serve as an independent director.chairmanChairman and chief executive officerCEO based on what it believes best serves the needs of the Company and its stockholders at any particular time. Both approaches have been taken depending on the circumstances. The determination to appoint Mr. Davis as Executive Chairman was based on a number of factors that made him particularly well-suited for the role. These factors included his prior position as Chairman and CEO, his prior service on the Board of Directors and its Compensation Committee, and his understanding of the Company'sCompany’s business and day-to-day operations, growth opportunities, challenges and risk management practices. This combination of Company experience and expertise enables Mr. Davis to provide strong and effective leadership to the Board of Directors and to ensure that the Board of Directors is informed of important issues. In consultation with our Lead Independent Director, the also meet without management present at other times as requested by any independent director. As Lead Independent Director, Dr. Barrett chairs the executive sessions of the Board of Directors. Committees of the Board of DirectorsThe standing committees of our Board of Directors are the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Academic Committee. As of the date of this Proxy Statement, membership on the Committees of the Board of Directors is as follows:

Audit CommitteeThe Audit Committee, which was established in accordance with Section 3(a)(58)(A) of the Exchange Act, consists of Mr. Fink, who serves as the Chairman, Ms. Alvarez and Mr. Bron. Our Board of Directors has determined that each of Messrs. Fink and Bron and Ms. Alvarez qualify as independent directors under the applicable NYSE listing requirements and SEC regulations.The Audit Committee met seven times during fiscal 2018. The meetings to review the Company's quarterly and annual periodic filings with the SEC each include at least two separate sessions (which together count as only one meeting). Mr. Fink engaged in routine separate communications with the Company's external auditors and Chief Financial Officer, held the required executive sessions at each meeting, and requested participation by outside counsel, as needed. The Audit Committee has a charter, available on our website at www.K12.com, setting forth its structure, powers and responsibilities. Pursuant to the charter, the Audit Committee is comprised of at least three members appointed by our Board of Directors, each of whom satisfies the requirements of independence and financial literacy. In addition, our Board has determined that Messrs. Fink and Bron and Ms. Alvarez are each an audit committee financial expert, as that term is defined under the Exchange Act. Under its charter, the responsibilities of the Audit Committee include:•discussing with our independent registered public accounting firm the conduct of the annual audit, the adequacy and effectiveness of our accounting, the effectiveness of internalcontrol over financial reporting, and applicable requirements regarding auditor independence;•approving the audited financial statements of the Company to be included in our Annual Report on Form 10-K;•reviewing and recommending annually to our Board of Directors the selection of an independent registered public accounting firm;•pre-approving all audit and non-audit services and fees associated with our independent registered public accounting firm; and•reviewing and discussing with management significant accounting matters and disclosures.In addition, our Corporate Governance Guidelines provide that members of the Audit Committee may not serve on the audit committees of more than two other companies at the same time as they serve on our Audit Committee.Compensation CommitteeThe Compensation Committee consists of Mr. Engler, who serves as the Chairman, and Messrs. Fink and Knowling. Our Board of Directors has determined that each of Messrs. Engler, Fink and Knowling qualify as independent directors within the meaning of the applicable NYSE listing requirements and SEC regulations.The Compensation Committee met seven times during fiscal 2018. The Compensation Committee has a charter, available on our website at www.K12.com, setting forth its structure, powers and responsibilities. These include:•reviewing the compensation philosophy of our Company;•reviewing, approving and recommending corporate goals and objectives relating to the compensation of our Chairman and CEO and, based upon an evaluation of the achievement of these goals, recommending to the Board of Directors our Chairman and CEO's total compensation;•reviewing and approving salaries, bonuses and other forms of compensation for our other executive officers, including without limitation stock options, restricted shares, and other forms of equity compensation;•considering and adopting changes to our compensation structure as applicable to all non-executive officer employees, including, but not limited to, salaries and benefits; and•performing such duties and exercising such authority as may be assigned by the Board of Directors, including under the terms of our equity incentive and bonus plans.On the recommendation of the Nominating and Corporate Governance Committee, Mr. Knowling was appointed to the Board of Directors and the Compensation Committee. Accordingly, he is standing for election as a director for the first time.Nominating and Corporate Governance CommitteeThe Nominating and Corporate Governance Committee consists of Ms. McFadden, who serves as the Chairman, and Messrs. Bron and Engler. Our Board of Directors has determined that each ofMs. McFadden and Messrs. Bron and Engler qualify as independent directors within the meaning of the applicable NYSE listing requirements and SEC regulations. Our Board of Directors has adopted Corporate Governance Guidelines which are available on our website at www.K12.com.The Nominating and Corporate Governance Committee met three times during fiscal 2018. The Nominating and Corporate Governance Committee has a charter, available on our website at www.K12.com, setting forth its structure, powers and responsibilities. Under its charter, the Nominating and Corporate Governance Committee has the authority to nominate persons to stand for election and to fill vacancies on our Board of Directors. The Nominating and Corporate Governance Committee may consider the following criteria, as well as any other factors it deems appropriate, in recommending candidates for election to our Board of Directors:•personal and professional integrity, ethics and values;•experience in corporate management, such as serving as an officer or former officer of a publicly traded company, and a general understanding of marketing, finance, operations, governance and other elements relevant to the success of the Company in today's business and regulatory environment;•experience in the field of education policy and administration;•service as a board member of another publicly traded company; and•practical and mature business judgment, including the ability to make independent analytical inquiries.In fiscal 2017, the Board amended its Corporate Governance Guidelines to expressly include consideration of diversity in identifying director nominees. The Board strives to nominate directors with a variety of complementary skills so that, as a group, the Board of Directors will possess a mix of the appropriate backgrounds, talent, gender, race, perspectives, skills and expertise to oversee the Company's business. Currently, our eight member Board has two Hispanic directors, two African American directors, and two female directors. The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders, provided such recommendations are submitted in writing not later than the close of business on the 90th day, or earlier than the close of business on the 120th day, prior to the anniversary of the preceding year's annual meeting of the stockholders. Such recommendations should include the name and address and other pertinent information about the candidate as is required to be included in the Company's proxy statement. Recommendations should be submitted to the corporate secretary of the Company at K12 Inc., 2300 Corporate Park Drive, Herndon, VA 20171, Attention: General Counsel and Secretary. The Nominating and Corporate Governance Committee will consider the criteria set forth above and other relevant information when evaluating director candidates recommended by stockholders.Academic CommitteeThe Academic Committee consists of Dr. Barrett, who serves as the Chairman, and Messrs. Davis and Engler. The primary role of the Academic Committee is to make recommendations and assist management in discharging its responsibility to ensure continuous improvement in academic outcomes for the students and schools we serve.The Academic Committee has a charter, available on our website at www.K12.com, setting forth the structure, powers and responsibilities of the Academic Committee. Members of the Academic Committeeparticipated in three meetings of the Company's Educational Advisory Committee during fiscal 2018. Under its charter, the responsibilities of the Academic Committee include:•monitoring the effectiveness of the Company's education products and services;•evaluating and implementing recommendations of the Company's Educational Advisory Committee; and•making recommendations to the Board of Directors and management to ensure continuous improvement in academic outcomes for the public and private schools served by the Company.setsset the agenda for the Board of Directors'Directors’ meetings, each functional division of the Company can identify risk-related topics that may require added attention, which have included evolving state curriculum standards, student engagement and retention, education technology, legal and policy matters, information security, and succession planning. Each quarter, our Executive Chairman and CEO also presentspresent an assessment of the strategic, financial and operational issues facing the Company, which frequently includes a review of associated risks and opportunities.2018,2021, the Audit Committee continued to work directly with a major independent accounting firm to support the Company'sCompany’s internal audit function in risk management. This combination provides us with the focus, scope, expertise and continuous attention necessary for effective risk management.•Company'sCompany’s policies with respect to those matters. Our internal audit department prepares various risksemi-annual reports to the Audit Committee on the Company'sCompany’s legal risks and compliance-related matters in the schools we serve and at the corporate level.•55.•for our directors and corporate governance.2018,2021, pursuant to our Amended Non-Employee Directors Compensation Plan ("(“Directors Compensation Plan"Plan”), our non-employee directors receivedwere eligible to receive annual cash retainers for service on theour Board of Directors and assigned committees and annual restricted stock awards. Mr. Davis, our Executive Chairman, and Mr. Rhyu, our CEO, received no additional compensation for histheir service on our Board of Directors. Amounts paid to Mr. Chavous, our President, Academics, Policy and Schools, for his partial year of service as a non-employee director during fiscal 2018 are set forth below in our "Summary Compensation Table for Fiscal 2018".$60,000$70,000, the Lead Independent Director receives an additional $25,000, and each non-employee director receives an additional amount for each committee on which the non-employee director serves, as shown below: Additional Cash

RetainerCommittee Chair Member $35,000 $10,000 $15,000 $5,000 $10,000 $5,000 $5,000 $5,000 The Directors Compensation Plan also provides forIn January 2021, each non-employee director received an annual restricted stock awards for each non-employee director,award valued at $100,000$145,000 as of the grant date, (prorated for a partial year of service), with the shares of our Common Stock underlying such awards vesting fully one year from the date of the grant. The annual cash retainer, including the committee fees, and the annual restricted stock awards were granted on January 2, 2018 to all non-employee directors who held such positions ataward may be deferred in the beginningform of the calendar year.

21 |

Table of ContentsTABLE OF CONTENTS

| | Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Total ($) | |

| | Aida M. Alvarez(2) | | | 75,000 | | | 145,000 | | | 220,000 | |

| | Craig R. Barrett(3) | | | 75,000 | | | 145,000 | | | 220,000 | |

| | Guillermo Bron(4) | | | 75,000 | | | 145,000 | | | 220,000 | |

| | Robert L. Cohen(5) | | | 85,000 | | | 145,000 | | | 230,000 | |

| | John M. Engler(6) | | | 85,000 | | | 145,000 | | | 230,000 | |

| | Steven B. Fink(7) | | | 110,000 | | | 145,000 | | | 255,000 | |

| | Victoria D. Harker(8) | | | 80,000 | | | 145,000 | | | 225,000 | |

| | Robert E. Knowling, Jr.(9) | | | 85,000 | | | 145,000 | | | 230,000 | |

| | Liza McFadden(10) | | | 80,000 | | | 145,000 | | | 225,000 | |

| (1) | Represents the aggregate grant date fair values of stock awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) Topic 718. On January 4, 2021, each non-employee director who held such position at the beginning of the calendar year, was eligible to receive an award of 6,901 shares of restricted stock. Mr. Cohen and Mr. Knowling elected to receive their awards in deferred stock units under the Directors Deferred Compensation Plan. Ms. McFadden elected to receive 50% of her award in deferred stock units under the same plan. The restricted stock and deferred stock units vest on January 4, 2022. |

| (2) | As of June 30, 2021, Ms. Alvarez held 6,901 unvested restricted shares. |

| (3) | As of June 30, 2021, Mr. Barrett held 6,901 unvested restricted shares. |

| (4) | As of June 30, 2021, Mr. Bron held 6,901 unvested restricted shares. |

| (5) | As of June 30, 2021, Mr. Cohen held 6,901 unvested deferred stock units. |

| (6) | As of June 30, 2021, Mr. Engler held 6,901 unvested restricted shares. |

| (7) | As of June 30, 2021, Mr. Fink held 6,901 unvested restricted shares. |

| (8) | As of June 30, 2021, Ms. Harker held 6,901 unvested restricted shares. |

| (9) | As of June 30, 2021, Mr. Knowling held 6,901 unvested deferred stock units. |

| (10) | As of June 30, 2021, Ms. McFadden held 3,450 unvested deferred stock units and 3,451 unvested restricted shares. |

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) (1) | Total ($) | | ||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

Aida M. Alvarez (2) | 70,000 | 100,000 | 170,000 | |||||

| | | | | | | | | |

Craig R. Barrett (3) | 65,000 | 100,000 | 165,000 | |||||

| | | | | | | | | |

Guillermo Bron (4) | 75,000 | 100,000 | 175,000 | |||||

| | | | | | | | | |

John M. Engler (5) | 85,000 | 100,000 | 185,000 | |||||

| | | | | | | | | |

Steven B. Fink (6) | 100,000 | 100,000 | 200,000 | |||||

| | | | | | | | | |

Robert E. Knowling, Jr. (7) | 30,719 | 97,264 | 127,983 | |||||

| | | | | | | | | |

Liza McFadden (8) | 61,236 | 141,376 | 202,612 | |||||

| | | | | | | | | |

Jon Q. Reynolds (9) | 16,250 | — | 16,250 | |||||

| | | | | | | | | |

Andrew H. Tisch (10) | 36,250 | — | 36,250 | |||||

| | | | | | | | | |

(1)Represents the aggregate grant date fair values of stock awards computed in accordance with FASB ASC Topic 718. On January 2, 2018, each non-employee director who held such position at the beginning of the calendar year, received an award of 6,208 shares of restricted stock that vests on January 2, 2019.(2)As of June 30, 2018, Ms. Alvarez held 6,208 unvested restricted shares.(3)As of June 30, 2018, Mr. Barrett held 10,107 unvested restricted shares.(4)As of June 30, 2018, Mr. Bron held 10,107 unvested restricted shares.(5)As of June 30, 2018, Mr. Engler held 10,107 unvested restricted shares.(6)As of June 30, 2018, Mr. Fink held 10,107 unvested restricted shares.(7)Mr. Knowling joined the Board of Directors in January 2018. The amounts shown represent a pro-rated portion of Mr. Knowling's annual retainer and annual restricted stock award based on his partial year of service. As of June 30, 2018, Mr. Knowling held 6,045 unvested restricted shares.(8)As of June 30, 2018, Ms. McFadden held 8,526 unvested restricted shares. The amounts shown include a pro-rated portion of Ms. McFadden's annual retainer and annual restricted stock award based on her partial year of service for 2017 granted August 19, 2017, and her annual retainer and annual restricted stock award for fiscal 2018 granted January 2, 2018.(9)On August 7, 2017, Mr. Reynolds resigned from the Board of Directors. The amount of fees shown represents a pro-rated portion of Mr. Reynolds's annual retainer based on his partial year of service. Mr. Reynolds was not granted a restricted stock award for fiscal 2018 and did not hold any unvested restricted shares as of June 30, 2018.(10)Mr. Tisch did not stand for re-election at the 2017 Annual Meeting of Stockholders and his term on the Board of Directors expired on December 14, 2018. The amount of fees shown represents a pro-rated portion of Mr. Tisch's annual retainer based on his partial year of service. Mr. Tisch was not granted a restricted stock award for fiscal 2018 and did not hold any unvested restricted shares as of June 30, 2018.

Please see the Security Ownership of Certain Beneficial Owners and Management table starting on page 6131 for additional information on the beneficial ownership of the Company'sour Common Stock by each of our directors.

22 |

all or a portion of their cash and equity compensation for service on our Board of Directors. In the case of a deferral of an equity award, the non-employee director is granted an equal amount of deferred stock units in lieu of restricted shares. Deferred stock units granted in lieu of a restricted stock award are subject to the same vesting requirements or other restrictions that would have applied to such restricted stock award. Corporate Governance Guidelines and Code of Ethics and Business Conduct periodically amended as the Board of Directors enhances the Company’s corporate governance practices. The ContentsPROPOSAL 1:ELECTION OF DIRECTORScurrentlyoversees the management of the Company and its business for the benefit of our stockholders in order to enhance stockholder value over the long term and to achieve its educational mission. The Board of Directors also has eight members: Aida M. Alvarez, Craig R. Barrett, Guillermo Bron, Nathaniel A. Davis, John M. Engler, Steven B. Fink, Robert E. Knowling, Jr.adopted Corporate Governance Guidelines to assist it in the exercise of its responsibilities. The Guidelines are reviewed annually and Liza McFadden.termBoard of officeDirectors has also adopted a Code of each memberBusiness Conduct and Ethics that applies to all directors, officers and employees. The purpose of this code is to promote honest and ethical conduct for conducting the business of the Company, consistent with the highest standards of business ethics. The Corporate Governance Guidelines and Code of Business Conduct and Ethics are available on our website at https://investors.stridelearning.com/governance.expires at the Annual Meeting, or in the case of a transaction in which the aggregate amount is, or is expected to be, in excess of $250,000, the Board of Directors will review the relevant facts and circumstances of all related party transactions, including, but not limited to: (i) whether the transaction is on terms comparable to those that could be obtained in

23 |

Upon the recommendation of our Nominating and Corporate Governance Committee,written charter adopted by the Board of Directors, has approved the nomination of eight directors, Aida M. Alvarez, Craig R. Barrett, Guillermo Bron, Nathaniel A. Davis, John M. Engler, Steven B. Fink, Robert E. Knowling, Jr. and Liza McFadden, for election atAudit Committee, or the Annual Meeting to serve until“Committee”, assists the next annual meeting of the stockholders (or until such time as their respective successors are elected and qualified or their earlier resignation, death, or removal from office).

Our Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the Company’s financial reporting processes and its internal audit function. Management has no reasonthe primary responsibility for the financial statements and the reporting process, including the system of internal controls and for assessing the effectiveness of the Company’s internal control over financial reporting. The independent auditors are responsible for performing an independent audit of the Company’s consolidated financial statements and internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board and for issuing reports thereon.

24 |

| | | | Members of the Audit Committee | |

| | | | ||

| | | | Steven B. Fink (Chairman) | |

| | | | Robert L. Cohen | |

| | | | Victoria D. Harker |

| | | | 2021 | | | 2020 | | |

| | Audit Fees | | | $1,227,008 | | | $1,400,200 | |

| | Audit-Related Fees | | | 47,272 | | | 25,000 | |

| | Tax Fees | | | — | | | — | |

| | All Other Fees | | | — | | | — | |

| | Total | | | $1,274,280 | | | $1,425,200 | |

25 |

vote at the Annual Meeting is required to ratify the appointment of BDO USA as the Company’s independent registered public accounting firm.

APPOINTMENT OF BDO USA AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JUNE 30, 2022.

26 |

Set forth below are the names and other information pertaining to each person nominatedfollowing resolution:

Aida M. Alvarez, Age 69

Ms. Alvarez joined us a director in April 2017 and is a member of our Audit Committee. She currently serves as Chair of the Latino Community Foundation. As Administrator of the U.S. Small Business Administration, she was a member of President Clinton's Cabinet from 1997 to 2001. Previously, Ms. Alvarez served as the Director of the Office of Federal Housing Enterprise Oversight from 1993 to 1997, where she was charged with financial oversight of the secondary housing market, the Federal National Mortgage Association ("Fannie Mae") and the Federal Home Loan Mortgage Corporation ("Freddie Mac"). Prior to that, she worked for the New York City Health and Hospitals Corporation, Bear Stearns & Company, Inc. and the First Boston Corporation. She has served on the boards of directors of Oportun, Inc. (formerly Progress Financial Corporation) since 2011; Zoosk, Inc. since 2014; and HP Inc. since February 2016. From 2006 to June 2016, Ms. Alvarez served on the board of Wal-Mart Stores Inc., and from 2004 to 2014, served on the boards of MUFG Americas Holdings Corporation (formerly UnionBanCal Corporation) and MUFG Union Bank N.A. (formerly Union Bank N.A.). Ms. Alvarez holds a Bachelor's Degree from Harvard College. Ms. Alvarez was selected as a director because of her financial expertise, government experience, and ability to bring diverse perspectives to the Board.

Craig R. Barrett, Age 79

Dr. Barrett joined us as a director in September 2010, currently serves as Chairman of our Academic Committee and became our Lead Independent Director in September 2017. He served as Chairman and Chief Executive Officer of Intel Corporation from 1998, until his retirement in 2009, having served in various roles, including Chief Operating Officer, since joining Intel Corporation in 1974. Prior to Intel Corporation, Dr. Barrett was a member of the Department of Materials Science and Engineering faculty of Stanford University. Dr. Barrett currently serves as Co-Chairman of Achieve, Inc., an independent, bipartisan, non-profit education reform organization; President and Chairman of BASIS Schools, Inc.; Vice Chair of the Science Foundation Arizona; and Co-Chairman of the Business Coalition for Student Achievement. Dr. Barrett holds a B.S., M.S. and Ph.D. in Materials Science from Stanford University. Dr. Barrett was selected as a director because of his deep knowledge and experience in information technology innovation, as well as his global, operational, and leadership experience as Chairman and Chief Executive Officer of Intel Corporation. He also brings a unique perspective to the Our Board of Directors from his tenure as a professor and his volunteer work and support of numerous educational organizations.

Guillermo Bron, Age 66

Mr. Bron joined us as a director in July 2007 and currently serves as a memberour Compensation Committee value the opinions of our stockholders, and to the extent there is a significant vote against the NEO compensation, as disclosed in this Proxy Statement, we will consider our stockholders’ concerns and will evaluate what, if any, further actions are necessary to address those concerns. We expect to hold our next Say-on-Pay vote at our 2022 annual meeting of stockholders.

27 |

| 1. | Company policies and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications. |

| 2. | Payments by Stride or any subsidiary used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the amount of the payment and the recipient. |

| 3. | Stride or any subsidiary’s membership in and payments to any tax-exempt organization that writes and endorses model legislation. |

| 4. | Description of management’s and the Board’s decision-making process and oversight for making payments described in sections 2 and 3 above. |

1 | See https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2018&id=D000044946 and https://www.opensecrets.org/federal-lobbying/clients/summary?cycle=2020&id=D000044946 |

2 | https://www.edweek.org/policy-politics/outsized-influence-online-charters-bring-lobbying-a-game-to-states/2016/11 |

28 |

Nathaniel A. Davis, Age 64

Mr. Davis joined us as a director in July 2009 and has served as our Chairman since June 2012. In January 2013, he became our Executive Chairman, and in January 2014, Mr. Davis was appointedother stakeholders to be our CEO, servingan active participant in that role through February 2016the political process, to inform policy and again beginning in March 2018. He also is a memberdecision makers of our Academic Committee. Priorviews on issues and to joiningdevelop and maintain strong working relationships with governmental decision makers.

3 | https://www.the74million.org/article/3-states-tried-to-shutter-failing-for-profit-online-charter-schools-a-suspicious-pattern-of-allegationsccusations-and-legal-complaints-quickly-follow |

4 | https://www.alec.org/article/emergency-crisis-remote-learning-is-not-virtual-schooling/ |

5 | https://theintercept.com/2018/11/29/alec-corporate-funders-charles-koch/ |

29 |

Communications and Telica Switching. Mr. Davis holds an M.B.A. from the Wharton Schoolconcerns of the University of Pennsylvania, an M.S.stakeholders. While the Proponent implies that lobbying exposes our Company to risks, we believe that the failure to engage in Engineering Computer Science at the Moore School of the University of Pennsylvania, andcritical public policy developments that impact our business would present a B.S. in Engineering from Stevens Institute of Technology. Mr. Davis was selected as a director based on his strong record of executive management, finance and systems engineering skills,far greater risk to stockholders’ interests as well as his insight intoto those of our stakeholders.

30 |

John M. Engler, Age 70

Mr. Engler joined useach NEO and all directors and executive officers of the Company as a group, except as qualified by the information set forth in the notes to this table. To our knowledge, except as noted below, no person or entity is the beneficial owner of more than 5% of the voting power of the Company’s voting securities. As of October 18, 2021, 42,766,739 shares of our Common Stock were outstanding.

| | | | Shares Beneficially Owned(1) | | ||||

| | | | Shares of Common Stock | | | Percent | | |

| | James J. Rhyu(2) | | | 525,778 | | | 1.23% | |

| | Kevin P. Chavous(3) | | | 250,025 | | | * | |

| | Shaun E. McAlmont(4) | | | 120,091 | | | * | |

| | Vincent W. Mathis(5) | | | 95,876 | | | * | |

| | Timothy J. Medina(6) | | | 96,242 | | | * | |

| | Nathaniel A. Davis(7) | | | 1,096,027 | | | 2.56% | |

| | Aida M. Alvarez(8) | | | 27,946 | | | * | |

| | Craig R. Barrett(9) | | | 63,595 | | | * | |

| | Guillermo Bron(10) | | | 66,103 | | | * | |

| | Robert L. Cohen(11) | | | 16,102 | | | * | |

| | John M. Engler(12) | | | 58,284 | | | * | |

| | Steven B. Fink(13) | | | 155,391 | | | * | |

| | Victoria D. Harker(14) | | | 12,185 | | | * | |

| | Robert E. Knowling, Jr.(15) | | | 17,868 | | | * | |

| | Liza McFadden(16) | | | 26,394 | | | * | |

| | All Directors and Executive Officers as a Group (15 persons)(17) | | | 2,627,907 | | | 6.14% | |

| | BlackRock, Inc.(18) | | | 3,001,694 | | | 7.02% | |

| | The Vanguard Group(19) | | | 3,554,797 | | | 8.31% | |

| | Dimensional Fund Advisors(20) | | | 3,174,839 | | | 7.42% | |

| * | Denotes less than 1%. |

| (1) | Beneficial ownership of shares is determined in accordance with the rules of the SEC and generally includes any shares over which a person or entity exercises sole or shared voting or investment power. Except as indicated by footnote, and subject to applicable community property laws, to our knowledge, each stockholder identified in the table possesses sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned by the stockholder. The number of shares beneficially owned by a person or entity includes shares of Common Stock subject to options held by that person or entity that are currently exercisable or exercisable within 60 days of October 18, 2021 and not subject to repurchase as of that date. Shares issuable pursuant to options and deferred stock units are deemed outstanding for calculating the percentage ownership of the person holding the options but are not deemed outstanding for the purposes of calculating the percentage ownership of any other person. |

| (2) | Includes 116,510 unvested shares of restricted Common Stock that are subject to forfeiture. |

31 |

| (3) | Includes 32,920 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (4) | Includes 31,486 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (5) | Includes 34,014 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (6) | Includes 56,639 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (7) | Includes 104,862 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (8) | Includes 6,901 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (9) | Includes 6,901 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (10) | Includes 6,901 unvested shares of Common Stock that are subject to forfeiture. |

| (11) | Includes 6,901 deferred stock units that are subject to forfeiture. |

| (12) | Includes 6,901 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (13) | Includes 6,901 unvested shares of restricted Common Stock that are subject to forfeiture. Mr. Fink has voting and investment control with respect to the securities held by S&C Fink Living Trust. |

| (14) | Includes 6,901 unvested shares of restricted Common Stock that are subject to forfeiture. |

| (15) | Includes 6,901 deferred stock units that are subject to forfeiture. |

| (16) | Includes 3,450 deferred stock units and 3,451 unvested shares of Common Stock that are subject to forfeiture. |

| (17) | Includes 421,288 unvested shares of restricted Common Stock and 17,252 deferred stock units. The unvested shares of restricted Common Stock and deferred stock units are subject to forfeiture. |

| (18) | Based solely on publicly available filings with the SEC, including the Schedule 13G/A filed on February 5, 2021. The address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10055. |

| (19) | Based solely on publicly available filings with the SEC, including the Schedule 13G/A filed on February 10, 2021. The address for The Vanguard Group is 100 Vanguard Blvd., Malvern, PA 19355. |

| (20) | Based solely on publicly available filings with the SEC, including the Schedule 13G/A filed on February 12, 2021. The address for Dimensional Fund Advisors, LP is Building One 6300, Bee Cave Road, Austin, TX 78746. |

32 |

| | Section | | | Page | |

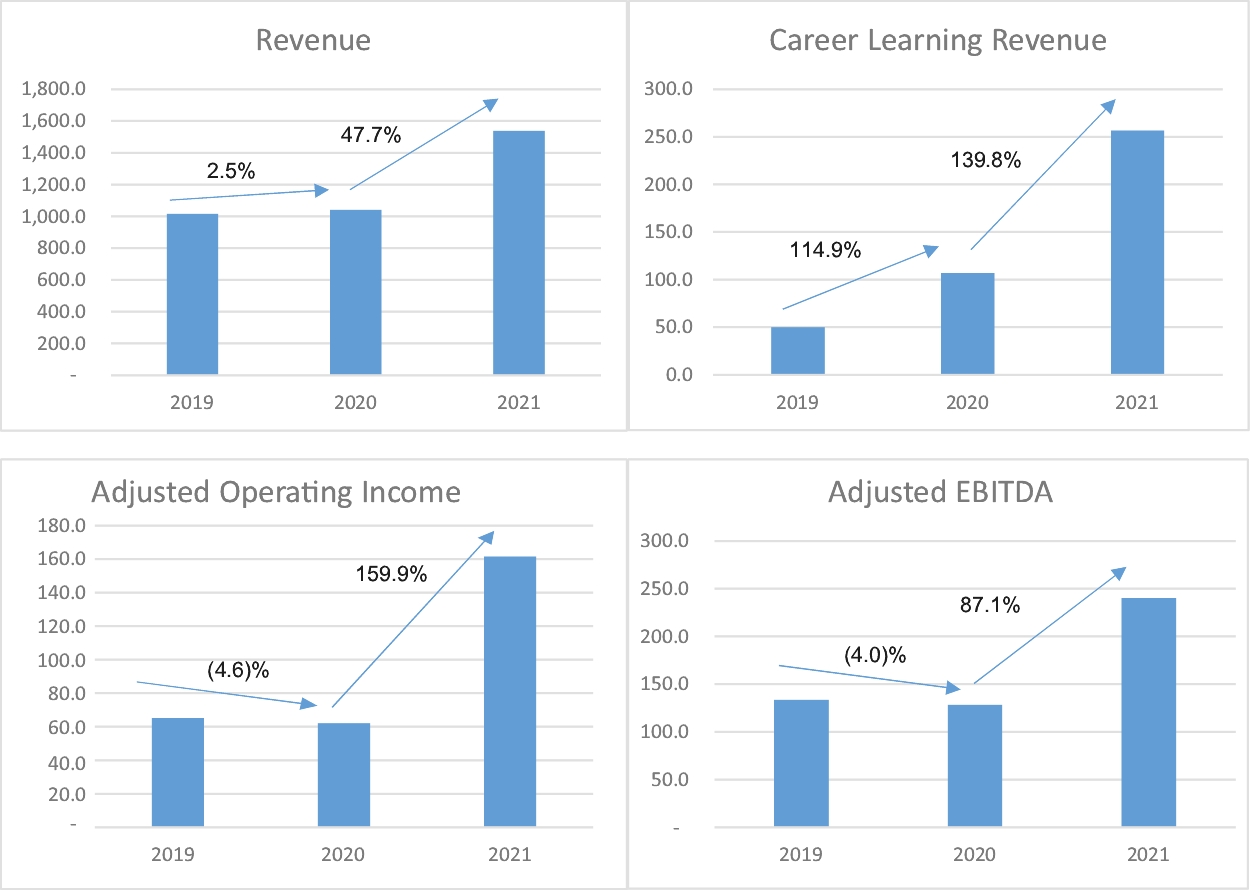

| | Executive Summary | | | 33 | |

| | What Guides our Program | | | 40 | |

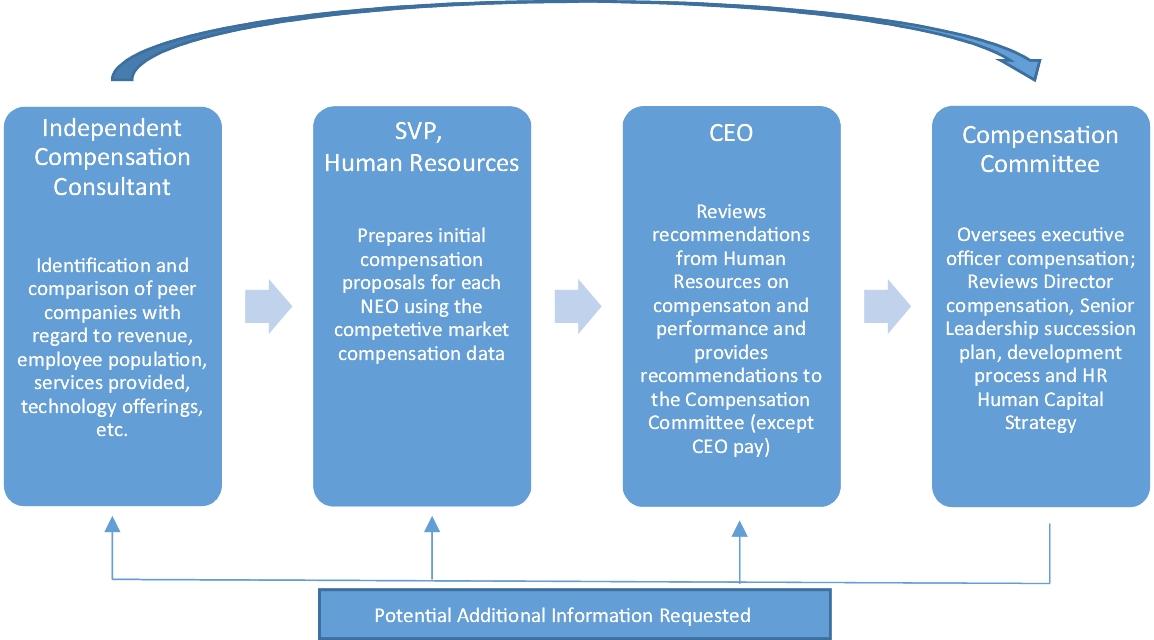

| | Compensation-Setting Process | | | 42 | |

| | Fiscal 2021 Executive Compensation Program in Detail | | | 45 | |

| | Severance and Change in Control Arrangements | | | 54 | |

| | Other Executive Compensation Practices and Policies | | | 55 | |

| | Named Executive Officer | | | Role |

| | Nathaniel A. Davis | | | Executive Chairman(1) |

| | James J. Rhyu | | | Chief Executive Officer(2) |

| | Timothy J. Medina | | | Chief Financial Officer |

| | Kevin P. Chavous | | | President, Academic Policy and External Affairs |

| | Shaun E. McAlmont | | | President, Career Learning Solutions(3) |

| | Vincent W. Mathis | | | Executive Vice President, General Counsel and Secretary |

| (1) | On January 20, 2021, Mr. Davis, Chairman of our Board of Directors and Chief Executive Officer of our Company, notified our Board of Directors that he would retire from his position as Chief Executive Officer, effective January 26, 2021. Mr. Davis continues to serve as Executive Chairman of the Company, effective January 26, 2021. |

| (2) | On January 20, 2021, our Board of Directors appointed Mr. Rhyu to succeed Mr. Davis as Chief Executive Officer of our Company, effective January 26, 2021. |

| (3) | On October 14, 2021, Dr. McAlmont notified us of his decision to resign from his position effective October 29, 2021 to pursue other opportunities. |

Steven B. Fink, Age 67

Mr. Fink joined us as a director in October 2003, currently serves as Chairman of our Audit Committee and is a member of our Compensation Committee. Mr. Fink is the Co-Chairman of Heron International. He served as a director of Nobel Learning Communities, Inc. from 2003 to 2011 and as Chairman of the Board of Life Storage, LLC from 2013 to 2016. In addition, Mr. Fink is a member of the Boards of Jackson Laboratories, City of Hope, St. Helena Hospital, Ole Health and the Herb Ritts Foundation, and is a member of The J. Paul Getty Photographs Council. From 1999 to 2009, Mr. Fink served as a director of Leapfrog, Inc. and was its Chairman from 2004 to 2009. From 2000 to 2008, Mr. Fink was the Chief Executive Officer of Lawrence Investments, LLC. Mr. Fink has also previously served as Chairman and Chief Executive Officer of Anthony Manufacturing, Chairman and Managing Director of Knowledge Universe and Chairman and Chief Executive Officer of Nextera. Mr. Fink holds a B.S. in Psychology from the University of California, Los Angeles and a J.D. and an L.L.M. from New York University. Mr. Fink was selected as a director based on his significant experience in operations and financial oversight gained as serving as director or chairman for various public and private companies in addition to his membership on various company audit committees which enables him to contribute significantly to the financial oversight, risk oversight and governance of the Company.

Robert E. Knowling, Jr., Age 63

Mr. Knowling joined us as a director in January 2018 and is a member of our Compensation Committee. Since May 2009, he has served as Chairman of Eagles Landing Partners, which specializes in helping senior management formulate strategy, lead organizational transformations, and re-engineer businesses. From 2002 to 2009 he served as Chief Executive Officer of the NYC Leadership Academy,

an independent non-profit corporation created by Chancellor Joel I. Klein and Mayor Michael R. Bloomberg that is chartered with developing the next generation of principals in the New York City public school system. Mr. Knowling has also held roles as Chief Executive Officer of Telwares, Chairman and Chief Executive Officer of SimDesk Technologies, Inc. and Chairman, President and Chief Executive Officer of Covad Communications. He was awarded the Wall Street Project's Reginald Lewis Trailblazers Award by President Clinton and the Reverend Jesse Jackson in 1999. Mr. Knowling serves on the board of directors for Roper Technologies, Inc. He also previously served on the board of Heidrick & Struggles, Inc. from 2010 to 2015 and Convergys Corporation from 2017 to 2018. He holds a B.A. in theology from Wabash College and an M.B.A. from Kellogg School of Management, Northwestern University. Mr. Knowling was selected as a director based on his experience in public education, public company leadership roles, technology and organizational development.

Liza McFadden, Age 55

Ms. McFadden joined us as a director in August 2017 and is a member of our Nominating and Corporate Governance Committee. Ms. McFadden currently leads LIZA and Partners LLC. Previously, she was President and Chief Executive Officer of the Barbara Bush Foundation for Family Literacy from 2012 to 2018. She is a former high school teacher, Florida Department of Education administrator, and served in Governor Jeb Bush's administration. Additionally, Ms. McFadden was appointed by President George W. Bush to serve on the National Institute for Literacy Board. She holds an M.A. from Florida State University and a B.A. from Fitchburg State University. Ms. McFadden was selected as a director because of her dedication to the education community and expertise in literacy.

Set forth below is biographical information for each of our current executive officers who is not also a director.

Kevin P. Chavous, President, Academics, Policy & Schools Group, Age 62

Mr. Chavous joined us in January 2017 and currently serves as President, Academics, Policy & Schools Group. He was a member of our Board of Directors from January 2017 to October 2017 before resigning to take his current position. Previously, he was the Founder and Chief Executive Officer of The Chavous Group, an educational consulting firm, a position he held from January 2012 until January 2018 and was a founding Board Member of the American Federation for Children ("AFC"). He served as AFC's Executive Counsel from 2012 to 2016. Previously, Mr. Chavous was a partner at the SNR Denton law firm from 2002 to 2012 and served as a member of the Council of the District of Columbia from 1993 to 2005, where he was Chair of the Council's Education Committee. He also has servedCommittee, and other members of management proactively engaged in extensive stockholder outreach prior to and following our 2020 annual meeting of

33 |

Vincent W.Medina, our Chief Financial Officer, Mr. Mathis, Executive Vice President,our General Counsel, and Secretary, Age 54

Mr. Mathis joined us in September 2018 and serves as Executive Vice President, General Counsel and Secretary. In this role, he has executive responsibility for providing comprehensive legal counsel forMs. Maddy, our business, including matters relating to securities, litigation, regulatory compliance, intellectual property, contracts and licensing, and corporate governance. Mr. Mathis has more than 20 years of legal experience counseling diverse global businesses. Prior to joining the Company, Mr. Mathis served as Senior Vice President, Corporate Affairs, Corporate SecretaryHuman Resources, and ChiefMr. Knowling continued their stockholder outreach efforts during the beginning of Stafffiscal 2022. At that time, we reached out to our top 25 stockholders, and as of September 1, 2021, have spoken with or are scheduled to speak with stockholders representing more than 30% of our outstanding Common Stock. In our outreach to stockholders, we have committed to maintaining an open and ongoing dialogue multiple times per year.

Tablefiscal 2020, we also learned that stockholders were appreciative of Contents

Shearman and Sterling, LLP and the United States Securities and Exchange Commission. He began his legal career at Venable, LLP. Mr. Mathis formerly servedour commitment to Corporate Sustainability, commenting on the Board of Directors of Indianapolis Power and Light Company Enterprises, Inc., AES Tietê Energia S.A., and AES Elpa S.A. In addition, he previously served on the Board of Directors at IPALCO Enterprises, Inc., DPL Inc. and The Dayton Power and Light Company and was Chairman of Eletropaulo Metropolitana Eletricidade de São Paulo S.A. Mr. Mathis holds a J.D. from the University of Virginia and a B.A.our first published ESG Report in Economics and Political Science from The University of Richmond.

James J. Rhyu, Chief Financial Officer and President, Product and Technology, Age 48

Mr. Rhyu joined us in June 2013 and serves as Chief Financial Officer and President, Product and Technology. Prior to joining the Company, Mr. Rhyu served as Chief Financial Officer and Chief Administrative Officer of Match.com, a subsidiary of publicly traded IAC/InterActiveCorp, since June 2011. In those roles, he was responsible for overseeing a broad range of functions, including finance, human resources, legal, information technology and operations, certain international operations and product development. Prior to his roles at Match.com, Mr. Rhyu was a Senior Vice President of Finance at Dow Jones & Company from January 2009 until May 2011, where he ran the global financial function. Previously, Mr. Rhyu served for three years as the Corporate Controller of Sirius XM Radio Inc. and its predecessor company, XM Satellite Radio,fiscal 2021, as well as servingour ongoing commitment to stockholder outreach. Our stockholders also noted key improvements in our executive compensation policies and practices, including our increased focus on performance-based equity awards to be earned based on quantifiable metrics, our enhanced disclosure of our stockholder outreach efforts, and our continued responsiveness to stockholder and proxy advisory firm feedback.

| | What We Heard | | | Action Taken | | | Effective |

| | Long-term incentive compensation awards have only a one-year performance period | | | - Going forward, 60% of total annual equity award value granted in the form of PSU awards, with performance to be based on three-year metrics - For fiscal 2022, the metrics selected are related to gross margin percentage and the compound annual growth rate (“CAGR”) of our stock price measured at the end of a three-year performance period | | | - Equity awards granted for fiscal 2022 |

34 |

| | What We Heard | | | Action Taken | | | Effective |

| | Long-term incentive compensation awards use only a single, absolute-based metric | | | - PSU awards use multiple absolute performance metrics: gross margin and a stock price CAGR for fiscal 2022 | | | - Equity awards granted for fiscal 2022 |

| | Size of equity awards granted to named executive officers in view of size of prior years’ awards | | | - Overall size of equity awards granted to Mr. Chavous and Dr. McAlmont in fiscal 2022 were smaller than equity awards granted to them in fiscal 2021 | | | - Equity awards granted for fiscal 2022 |

| | One-time award with performance metric enabling missed interim payments to be earned at end of the performance period | | | - Feedback received was in reference to a one-time award granted to our then-CEO and has not been and will not be repeated in future years. Further, any multi-year awards granted to an executive officer will not contain a “catch-up” feature similar to the award cited. One-time PSU award granted to Dr. McAlmont to accelerate growth of Career Learning business does not contain “catch-up” feature and shares not earned due to not meeting threshold revenue goal for fiscal 2021 were forfeited. | | | - Equity awards granted in fiscal 2021 |

35 |

COMPENSATION DISCUSSION AND ANALYSIS

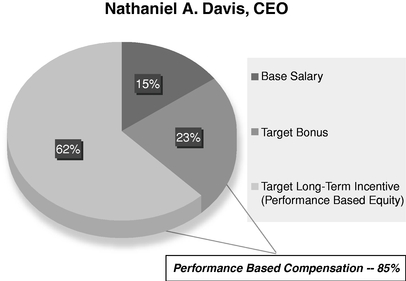

This Compensation Discussion and Analysis provides information about our fiscal 2018 compensationstretch performance levels have been established with award earning potential for the following named executive officers ("NEOs"):

•Nathaniel A. Davis, Chairmanat 50%, 100%, andCEO•James J. Rhyu, Chief Financial Officer200% of the target award payouts, respectively.

established threshold performance at the approved budget for the fiscal year.

virtual life experience for now.

In fiscal 2017 we saw this approach begin to yield some positive results and in fiscal 2018 our core business delivered further improvements in financial, operational and academic performance. Although our stock price has continued to face headwinds from the issues identified above, revenue growth, profitability and capital expenditures for the year met or exceeded our guidance and we saw the highest

student retention level in eight years. Based on these outcomes, we believe the strategy begun three years ago has worked in many respects, and during this time we formed an executive leadership team that is poised to continue the trend. To ensure the continuity of this progress, Mr. Davis was selected as the person best suited to spearhead K12's leadership team in its current phase and he re-assumed the position of CEO during fiscal 2018, a position he previously held from January 2014 to February 2016.

We have identified the following four cornerstones on which we intend to focus our efforts to accelerate our business growth and education mission:

•#1 Strengthening Our Core—Our Managed Public School programs remain the foundationoverall success of our business andthe improvements in retention makes us optimistic about its strength and potential for growth.•#2 Preparing Students for the Future—We are focused on building a more comprehensive career readiness programaligns managements’ interests witha distinct brand and better linkage to corporations, trade associations, and higher education institutions.•#3 Becoming a Trusted Advisor—Our management team is proactively complementing our content and services sales approach by positioning our Institutional business as a trusted software services provider delivering end to end digital learning solutions.•#4 Going Global—We continue to develop international opportunities by building partnership-focused relationships with in-country organizations.

We believe that by actively pursuing these strategic priorities, stockholders in K12 will realize the benefits of strong revenue and profitability growth, and just as importantly, see their investment provide educational choices and exceptional learning opportunities for students and families across the nation.

Stockholder Engagement and Compensation Reforms and Highlights

As we developed our executive compensation program for fiscal 2018, our Compensation Committee took into account the extensive stockholder input we received and took steps to more tightly link executive pay to measurable performance results. Over the last several years, we have extensively overhauled our executive compensation programs and practices, including making the following structural changes prior to fiscal 2018 (which were continued into fiscal 2018):

•Maintained salaries at prior year levels, with the average benchmarked near the 25thpercentile of the peer group and continued to emphasize pay-for-performance;•Granted no extraordinary or one-time bonus awards outsidethose of ourstandard executive compensation program;•Removed individual goals fromstockholders. Consistent with this philosophy, we reward ourannual cash bonus programexecutives forthe most senior executives; and•Expanded the use of performance-based stock awards and added stockholder return metrics as a feature of these awards.

Following these reforms, the annual stockholder advisory vote on our executive compensation for fiscal 2017 yielded an approval rate of 78.5%, which was a significant improvement over prior years. We view this as an endorsement of the positive changes we have made, but also recognize that it still reflects lingering concerns among a portion of our stockholder base. To understand, address and respond to those concerns consistent with the fiduciary duties of the Board of Directors, during fiscal 2018 we maintained our stockholder outreach efforts with the goal of receiving meaningful feedback. Accordingly,

at the beginning of fiscal 2018, we proactively reached outgreat performance relative to our top 25 stockholders, speaking with a total of five stockholders that respondedkey financial and in the aggregate held over 20% of our shares outstanding. Our Investor Relations and Human Resources leaders conducted the outreach efforts, with the Chairman of the Compensation Committee participating in some of the calls. We continued these discussions during the year through written correspondence and in-person stockholder meetings to continue our executive compensation dialogue.

The stockholders that we spoke with recognized and commended our continued responsiveness to their feedback such as the elimination of overlapping performance metrics in short- and long-term incentive pay programs and the introduction of longer term performance metrics in our 2016 LTIP.

These conversations centered on three key themes, which we have sought to address in a careful and deliberative manner so as to further our strategic business objectives:

Leadership Structure and Total Compensation Cost.

•Key Stockholder Concerns. Our stockholders expressed concerns over the total compensation cost associated with maintaining separate positions of an Executive Chairman and CEO with distinct roles and each receiving significant compensation amounts.•Fiscal 2018 Highlight—Streamlined Leadership Team. With the mid-year departure of Mr. Udell, our Board of Directors determined that a single executive position undertaken by Mr. Davis with his deep knowledge of our operations, relations with our major school board customers, and architect of our going forward strategy, would best serve the Company's needs at this time. During fiscal 2018 we consolidated the separate roles of a distinct CEO and Executive Chairman into the position of Chairman and CEO. We will continue to evaluate our executive leadership needs as we execute on our strategic business goals and priorities. To maintain flexibility and ensure that stockholders are not overly burdened with excessive severance costs, we also negotiated an arrangement that would eliminate our cash severance obligations to Mr. Davis in the event Mr. Davis is replaced by a new CEO. This resulted in a one-time equity incentive award for Mr. Davis that is subject to meaningful performance and other vesting conditions, which are described below under the heading "—Determination of Long-Term Incentive Compensation—Mr. Davis-Performance Based Restricted Stock Awards."•Fiscal 2018 Highlight—Reduced Leadership Compensation Burden. The consolidation of our Chairman and CEO positions resulted in an annual cost savings to the Company (based on total target-level compensation, including equity incentives) of approximately $1.8 million. In his role as Chairman and CEO, Mr. Davis' total target-level compensation package was set at a level comparable to his prior tenure in the CEO position, which ended in fiscal 2016.•Fiscal 2018 Highlight—No Salary Increases. As in fiscal 2017, we sought to limit total compensation costs by generally maintaining base compensation at prior year levels. Other than in connection with Mr. Davis assuming increased CEO duties, none of our NEOs received any increase in base salaries or target total compensation levels for fiscal 2018.

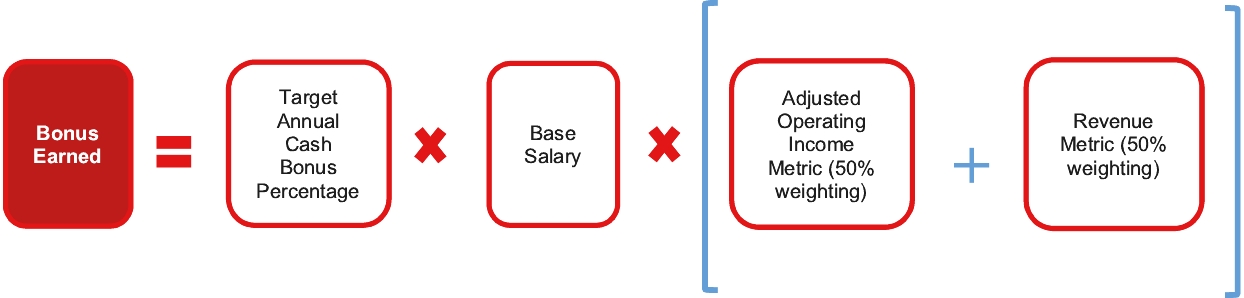

Annual Bonus Plan Structure and Payouts

•Key Stockholder Concerns. Our stockholders expressed concerns relating to our bonus plan structure, particularly its reliance for certain executives on individual performance goals and the use of quantitativeoperational metrics thatoverlap with our long-term incentive program. A few

•- drive stockholder value. Fiscal

2018 Highlight. In our continued effort to align our pay for performance practices with our strategy and stockholder value creation, we focused on restructuring our annual bonus plan for fiscal 2018, which included:•Eliminating individual criteria for our CFO, previously eliminated for our Chairman and CEO during fiscal 2017, and continuing to decrease the weighting of individual performance management objectives ("PMOs") for other executive officers from 50% to 30%.•Reducing the number of corporate PMOs for our most senior executives so that our annual bonus plan is tied to driving stockholder value through achievement of key financial metrics, operational goals and academic performance.•Removing performance metrics that overlap with our performance-based equity incentive awards to ensure that executives do not receive duplicate payouts for a singular achievement.•Updating the corporate PMOs to focus our executives on advancing our strategic priorities, which included adding a new a metric tied to our career and technical education ("CTE") enrollments.

•Fiscal 2018 Highlight. As the only publicly traded company in the K-12 space, comparison to our peer companies for purposes of setting target compensation levels present unique challenges. As a result, our stock price returns may not correlate strongly with our peer group. Going forward, to ensure alignment of realized pay amounts with corporate performance, we are enhancing our commitment toward establishing rigorous corporate level performance goals in our annual incentive program. Specifically, we set the fiscal year 2018 threshold performance targets at levels above the actual results for fiscal 2017 and target performance levels are directly tied to 2018 budgeted performance. Additionally, payout for threshold performance was reduced from 50% to 30% of target bonus.

stockholders also questioned why above-target bonus payouts were provided in years where our stock price performance has trailed members of our compensation peer group.

Long-Term Incentive Plan Structures